Fields of the Future.

- Investment Desk

- Dec 16, 2024

- 7 min read

With an estimated global population of 10 billion to feed by 2050 and dwindling resources to do so, the agriculture industry has evolved to become a technology driven sector. Kenya stands at the forefront in the African continent with developments in precision farming, agrifinance and smart supply chains. Supported by favorable policies and international investments, the country’s agritech landscape is transforming agriculture into an efficient, scalable and profitable industry, making it a compelling investment opportunity for investors.

Agriculture has evolved over the years, becoming more industrialized through the use of mechanical tools and advanced technology that allowed farmers to maximize crop yield and free up manpower. Despite this transformation, it always been viewed as a labor-intensive, low-tech, risky industry, with slow growth, and more so in developing countries like Kenya. However, recent developments in the industry could potentially change this dynamic.

Agricultural technology (abbreviated to agritech) is the use of technology to produce more with less, making the farming process as efficient as possible, from field monitoring to the food supply chain itself. The technological innovations aim to disrupt conventional agricultural practices that can be costly and inefficient by scaling yield, improving decision-making around farm management and providing financial resources for operations. Ultimately, these tools improve the yield, efficiency and profitability.

Agritech consists of five segments; precision agriculture, indoor farming, animal agriculture, agri-finance & e-commerce and agricultural biotech. Based on advanced data points, tracking analysis, and automation, precision agriculture (precision ag) holistically improves smart planting and crop management decisions. The farm management methodology uses robotic sensors, unmanned ground vehicles, and machinery to optimize field operations. IoT solutions employ sensors to help farmers predict in-field and soil variabilities while agricultural drones and other autonomous machines (which can get closer to plants without damage) gather aerial photos and seed fields.

Indoor farming is the process of growing food in controlled environments such as a building or a shipping container leading to a reduction of water, herbicides, pesticides usage. An example of this is indoor vertical farming where crops are grown in stacked layers, reducing the need for scarce, arable land which is highly advantageous for those living in urban areas. Animal agriculture (animal ag) develops technology to analyze and optimize animal welfare, health and production while Agrifinance & e-commerce provide financial support through loans, insurance and risk management tools. Online and e-commerce platforms connect distributors to customers allowing farmers to avoid traditional distribution systems. Agricultural biotech (Ag biotech) aims to reduce the harmful environmental impacts of faming by genetically modifying living organisms for specific agricultural uses. These solutions allow farmers to keep up with increasing food demands by making production cheaper and more efficient.

The industry represents a profitable opportunity for investors and while some may ask why, the answer is simple; we need to eat. The growing global population increases the demand for food and by 2050, the agricultural sector will need to feed an estimated 10 billion people. According to a recent World Economic Forum report, this would mean producing more than 70% of food than current levels with the same number of resources. We would need double the amount of food that we currently have just to avoid food security issues. Currently, more than 3 million children die annually due to lack of enough food and according to the Food and Agriculture Organization (FAO), an estimated 670 million people (8% of the world’s population) will be undernourished by 2030.

Significant pressures have required the agricultural industry to evolve, pushing innovations in the agricultural industry. More than 70% of food would need to be produced with the same number of resources by 2050 however, the input costs of generating this are rising. The rising energy, labor, and nutrient costs are already pressuring profit margins and by 2030, the water supply will fall 40% short of meeting global water needs. Approximately 25% of arable land is damaged and requires extensive restoration before it can support large-scale food production once more. Additionally, there are growing social and environmental pressures, such as the drive for more sustainable and ethical farming methods, such as stricter guidelines for farm animal welfare and less water and chemical use, as well as environmental pressures, such as climate change and the financial effects of extreme weather events. The agriculture sector needs to embrace a digital transformation made possible by connectivity in order to combat these forces that are about to further upend the sector, making a case for agritech. It is the future of the agriculture industry.

In Africa, the agriculture sector became a key economic driver post-independence due to the continent’s fertile lands and abundant resources. Employing over 60% of the continent’s workforce and contributing 14% of GDP in sub-Saharan Africa, the sector is the backbone of many African economies. However, the continent’s population is projected to reach 2.5 billion by 2050 while challenges like climate change, soil degradation, pests and limited access to modern farming techniques act as significant inhibitors to feeding the population. Agricultural technology presents a beacon of hope to the continent with projections indicating a potential boost of US$2.9 trillion by 2030 (% of GDP), underscoring its transformative potential. In Kenya where agricultural exports such as tea and coffee have contributed 20% of GDP and the sector employs over 40% of the total population, agtech adoption has the potential to revolutionize the industry.

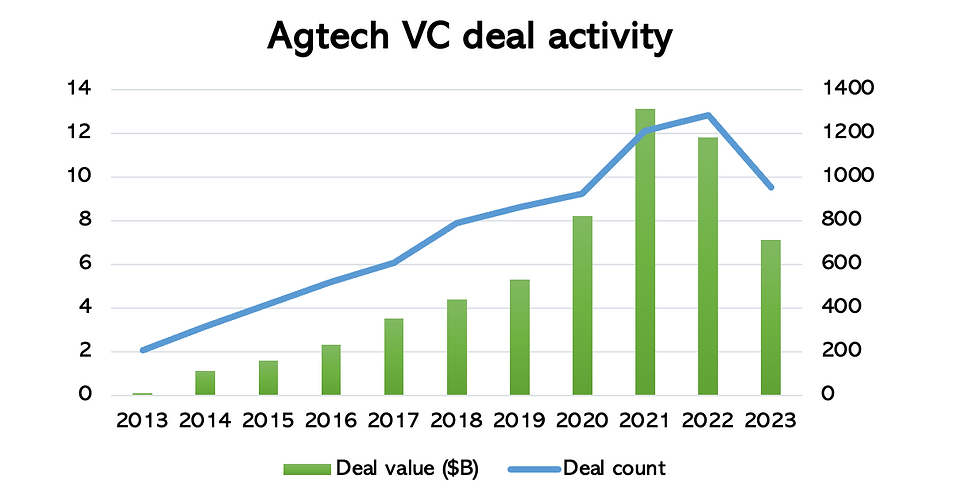

Agtech has been gaining traction over recent years with 8,576 companies and 25,107 deals as of 2023, globally. In terms of agtech adoption, European and North America lead with around 61% farmers currently using or planning to use technology in the next two years. Asia lags behind with only 9% adoption.

According to a recent PitchBook report, Africa has more than 500 agritech companies and global investors contributing a total of US$2.4 billion to African agritech ventures in the last 10 years with Kenya received the largest share of funding from this at US$83 million (37%). According to a 2024 AgFunder report, the country has been the most active this year, attracting more than half of total investments (US$157 million) at US$83 million. The Agrifinance & e-commerce category is the top-funded category in 2024 with the biggest deal amounting to US$35 million in Twiga Foods, an agribusiness that connects smallholder farmers to retailers.

SunCulture, which leverages solar-powered irrigation systems and remote monitoring to help farmers optimize water usage and improve yields, with customers reporting an increase in yields of up to 2-3 times. They successfully raised US$27.5 million in a Series B funding round this year. Other innovators like UjuziKilimo, a precision agribusiness provides data analytics tools that collect, analyze and make sense of agricultural data. SoilPal, for example, uses sensors to measure the nutrients in the soil and sends a report to farmers through SMS. The startup has already connected with more than 10,000 farmers.

iProcure, a B2B startup offers a digital supply chain platform, connecting agricultural manufacturers and distributors to local retailers. The company currently connects more than 5,000 retailers to different manufacturers. In the field of agrifintech, Pula, an agricultural insurance and technology company helps thousands of smallholder farmers in emerging markets gain access to insurance against floods, droughts, and other climate-related events. The company Pula closed a US$20 million Series B funding round to. Apollo Agriculture targets smallholder firms, offering loans, insurance and farming inputs, increasing farmers’ profits by 10-30% while achieving 99% loan repayment rates through their harvest-aligned models. The agrifintech business raised US$10 million in venture capital this year.

Established private sector players such as Safaricom and Twiga Foods are also accelerating agtech adoption by building digital and data infrastructure. For example, DigiFarm by Safaricom is an agri-tech platform that sustainably finances smallholder farms and connects them to quality products, services and markets. The platform has registered 1.6 million farmers and provided KES940 million in credit. Twiga Foods has guaranteed market access and better prices for 140,000 farmers while delivering reliable supply and reducing food losses for vendors.

Kenya’s agriculture sector stands out as an attractive investment opportunity, bolstered by strong government support. The Horticultural Crops Act of 2024, a bill that was recently passed by the government, aims to expedite the industry's growth, raise farmers' incomes, organize industry participants, draw in investments, ease produce exports, and, finally, protect food safety regulations.

The sector is also supported by a diverse range of technology-driven solutions that enhance the scalability, efficiency, and profitability of the agriculture sector attracting both local and international investors. This has been made clear, considering that the country has received the majority of continent’s investment funds in the last decade. Considering the above, Kenya’s agriculture industry presents a compelling, high-growth investment for those looking to tap into Africa’s agribusiness potential.

Agriculture is no longer just about subsistence or slow growth. It is becoming a high-tech, data-driven, and globally connected industry. Investors see the future potential due to rising global food demand, technological advances that reduce risk and increase profitability, and the drive for sustainable, climate-resilient solutions. All these factors, combined with favorable policies and impact investment trends, have made agriculture, especially in Kenya, a prime focus for investment now in a way it wasn’t before. As an investor, one question remains: will you lose out on one of the most exciting investment opportunities of our time, or will you take advantage of this chance to contribute to the transformation of agriculture?

Resources

Copyright ©2024 Reon Capital. All rights reserved.

The information, methodologies, data and opinions contained or reflected herein are proprietary of Reon Capital and/or its third parties’ suppliers (Third Party Data), intended for internal, non-commercial use, and may not be copied, distributed or used in any way, including via citation, unless otherwise explicitly agreed in writing. They are provided for informational purposes only and (1) do not constitute investment advice; (2) cannot be interpreted as an offer or indication to buy or sell securities, to select a project or make any kind of business transactions; (3) do not represent an assessment of the issuer’s economic performance, financial obligations nor of its creditworthiness.

These are based on information made available by third parties, subject to continuous change and therefore are not warranted as to their merchantability, completeness, accuracy or fitness for a particular purpose. The information and data are provided “as is” and reflect Reon Capital’s opinion at the date of their elaboration and publication. Reon Capital nor any of its third-party suppliers accept any liability for damage arising from the use of the information, data or opinions contained herein, in any manner whatsoever, except where explicitly required by law. Any reference to third party names or Third-Party Data is for appropriate acknowledgement of their ownership and does not constitute a sponsorship or endorsement by such owner.

Comments