UNRAVELLING TRADE TIES

- kelvinngobiro

- May 27, 2025

- 3 min read

Updated: May 29, 2025

Introduction: US Tariffs

The US’ decision in early 2025 to impose reciprocal tariffs on a wide range of countries, including several in Africa, marked what seems as a sharp departure from decades of trade policy. These tariffs undermine the African Growth and Opportunity Act (AGOA), the 25-year-old U.S. trade pact that has been providing duty-free access to the American market for many of African countries.

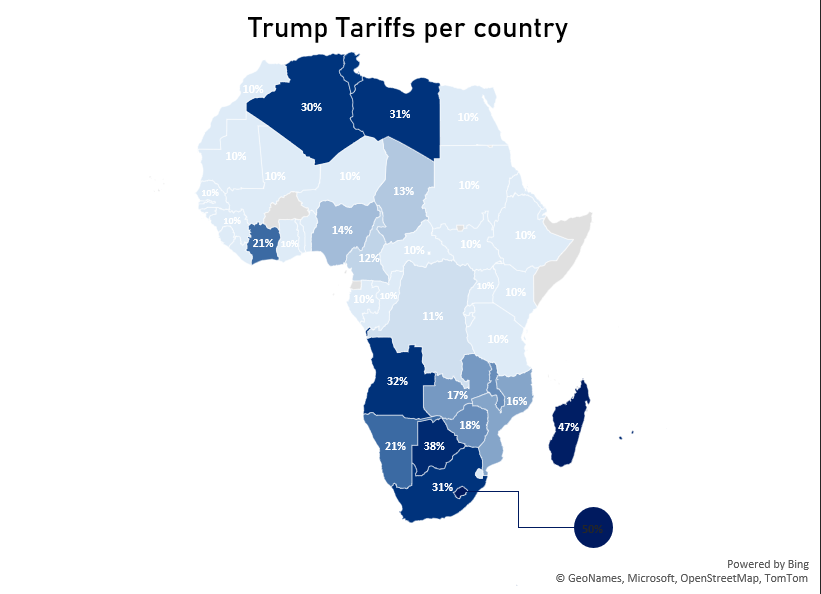

According to Bloomberg, the new tariffs will supersede the current trade era, effectively removing preferential treatment and subjecting African exports to steep duties. The tariff rates are based on each country’s trade surplus with the U.S., divided by its total exports and then halved to create a “discounted” figure. This has resulted in drastic variations in tariff levels, with some countries facing rates that threaten key sectors of their economies.

Source: White House

Uneven Fallout Across the Continent

Lesotho, for instance, has been severely affected, with a staggering 50% tariff. Minister of Trade and Industry Mokhethi Shelile warned that the move could place up to 12,000 textile jobs at risk, representing a third of the country’s employment in that industry. Given that textiles are Lesotho’s largest formal employment sector after the government, the impact is potentially catastrophic.

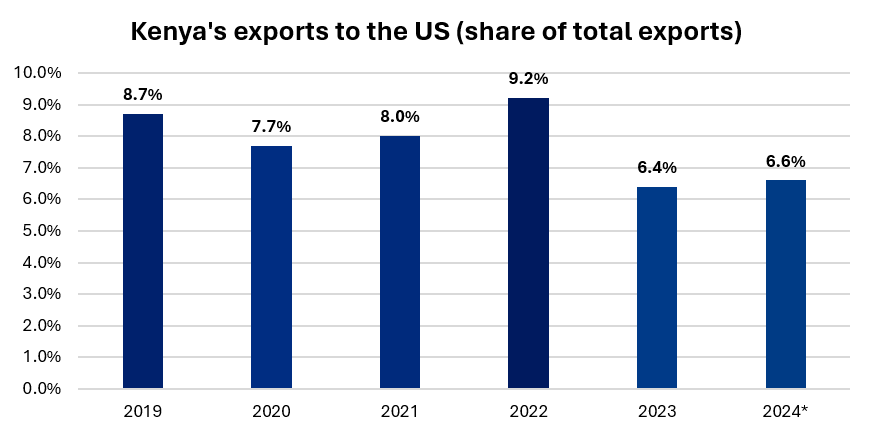

For Kenya, the economic hit is comparatively lighter but still significant in strategic sectors. The Central Bank of Kenya estimates that the country’s exports to the U.S. will fall by approximately Sh12.9 billion, or $100 million, which represents less than 1.2 percent of Kenya’s total exports of over Sh1 trillion and just 0.08% of its GDP, currently estimated at over $122 billion. The Bank downplayed the impact, noting that it remains manageable relative to the size of the economy, although 79.1 percent of Kenya’s exports to the U.S.—worth Sh50.8 billion—had accessed the market duty-free under AGOA.

Source: KNBS, 2024

The contrasting experiences of Lesotho and Kenya illustrate the unevenness of the fallout. Lesotho, heavily reliant on a single export sector, faces immediate social and economic risks. Kenya, with a more diversified economy and broader export base, can absorb the shock with less disruption. South Africa, while not the most tariffed, has also experienced pain, particularly in metals and manufacturing. With prior diplomatic tensions and growing interest in BRICS realignment, South Africa may further orient its trade policy toward multipolar collaboration, reducing its exposure to unilateral U.S. policy shifts.

Geopolitical Implications

These latest U.S. tariffs have both economic and geopolitical effects. For Africa-U.S. relations, the tariffs seem to have jeopardized Africa’s trade partnership with the U.S. This creates space for China, to deepen their economic ties within Africa, with projects such as Belt and Road initiative puts China in a good position to strengthen its economic foothold as African countries look eastward for stable trade partnerships.

Africa’s urgency to reduce reliance on any single trade partner is likely to rise, especially as global trade becomes increasingly fragmented along geopolitical lines. Beyond China, Africa may accelerate efforts to diversify its international trade engagements, strengthening ties with the European Union, India, and emerging economies across the Middle East and South America.

Conclusion and Outlook.

Globally, the World Trade Organization has forecast that the new U.S. tariffs could contribute to a 1% contraction in global merchandise trade volumes in 2025, compounding the economic strain for developing economies. For African nations, the long-term effect may be the reconfiguration of African trade relationships and economic priorities.